Bitcoin exchanges play a pivotal role in the cryptocurrency ecosystem, facilitating the buying, selling, and trading of bitcoins. Understanding the process of Bitcoin exchange is crucial for both beginners and experienced traders alike. Below, we'll delve into the intricate details of how Bitcoin exchanges function and offer guidance on navigating this dynamic landscape.

Once registered and verified, users can deposit funds into their exchange accounts. Exchanges usually support various deposit methods including bank transfers, credit/debit cards, and sometimes even other cryptocurrencies.

After initiating a deposit, users may need to wait for a certain confirmation period before the funds reflect in their exchange account.

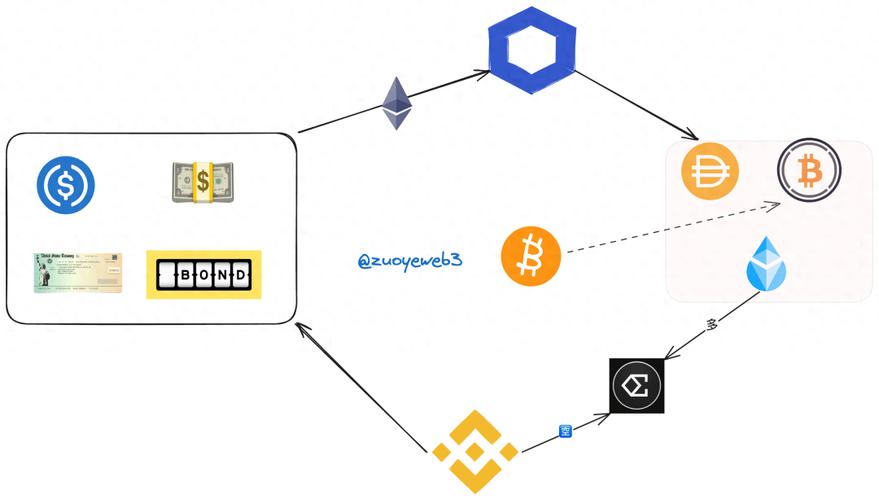

Bitcoin exchanges offer various trading pairs, allowing users to trade bitcoins against fiat currencies (like USD, EUR) or other cryptocurrencies (like Ethereum, Ripple).

Users can choose between different order types such as market orders, limit orders, and stop orders based on their trading strategies and preferences.

To buy or sell bitcoins, users need to place an order on the exchange platform. A market order executes immediately at the current market price, while a limit order allows users to specify the price at which they are willing to buy or sell.

Traders should carefully review their order details before finalizing to avoid any mistakes.

Once an order is placed, the exchange matches it with a corresponding buy or sell order from another user. This process is facilitated by the exchange's order matching engine.

Upon successful execution, the bitcoins are transferred from the seller's account to the buyer's account, and the corresponding funds are deducted or credited accordingly.

After completing trades or if users wish to hold their bitcoins outside the exchange, they can initiate a withdrawal request. This involves transferring bitcoins from the exchange wallet to an external wallet.

Users need to provide the recipient wallet address and may need to undergo additional security measures like twofactor authentication (2FA) for withdrawal confirmation.

It's crucial for users to prioritize security when using Bitcoin exchanges. This includes enabling twofactor authentication, using strong and unique passwords, and being cautious of phishing attempts.

Additionally, users should consider storing a significant portion of their bitcoins in a secure offline wallet (cold storage) for enhanced security against hacks and theft.

The cryptocurrency market is highly volatile and susceptible to rapid price fluctuations. Traders should stay informed about market trends, news, and regulatory developments to make informed trading decisions.

Being vigilant against scams, fraudulent schemes, and phishing attacks is paramount in safeguarding one's assets and personal information.

In conclusion, navigating the process of Bitcoin exchange involves several steps ranging from registration and verification to executing trades and prioritizing security. By understanding these processes and adopting best practices, users can effectively participate in the dynamic world of cryptocurrency trading while minimizing risks.

版权声明:本文为 “联成科技技术有限公司” 原创文章,转载请附上原文出处链接及本声明;